Are you in need of some extra cash but unsure about the best borrowing option for you? Understanding the difference between payday loans and personal loans can help you make an informed decision. In this blog post, we will explore the intricacies of both payday loans and personal loans, including how they work, their key differences, and a comparison of interest rates and fees. By the end of this post, you’ll have a better understanding of which loan option is better suited for your unique financial situation. Whether you’re facing a financial emergency or planning for a major expense, knowing the ins and outs of these borrowing options can help you make a well-informed decision for your financial well-being. So, let’s dive into the world of payday loans and personal loans and equip ourselves with the knowledge to make the best borrowing choice.

What are payday loans?

Payday loans are a type of short-term borrowing that is usually repaid within a few weeks, typically on the borrower’s next payday. These loans are designed to provide quick access to cash for individuals who need immediate funds to cover unexpected expenses or emergencies. They are often used by people who do not have access to traditional bank loans or credit cards, and may have limited options for borrowing money.

Payday loans are typically for small amounts, ranging from $100 to $1000, and are accompanied by high interest rates and fees. The application process for a payday loan is usually fast and easy, with minimal requirements for approval. Borrowers are typically required to provide proof of income, a valid ID, and a checking account.

One of the key features of payday loans is that they do not require a credit check, making them accessible to individuals with poor credit or no credit history. However, the convenience of payday loans comes at a cost, as the interest rates and fees associated with these loans can be extremely high, leading some borrowers into a cycle of debt and financial hardship.

It is important for potential borrowers to carefully consider the terms and costs of payday loans before taking out a loan, and to explore alternative options for borrowing money if possible.

How do payday loans work?

Payday loans are short-term loans that are typically used to cover emergency expenses such as car repairs, medical bills, or other unexpected financial needs. These loans are usually for small amounts, typically up to $500, and are meant to be repaid when the borrower receives their next paycheck. Payday loans are often considered a last resort for borrowers who cannot obtain a traditional loan from a bank or credit union.

When a borrower takes out a payday loan, they typically write a post-dated check for the full amount borrowed, plus any fees and interest, to the lender. The lender then gives the borrower the amount of the check, minus the fees and interest. When the borrower’s next payday arrives, the lender can either cash the check or the borrower can pay the loan back in cash. Alternatively, borrowers can also authorize the lender to electronically debit the funds from their bank account on the due date.

It’s important to note that payday loans often come with exorbitant interest rates and fees, which can trap borrowers in a cycle of debt. Many borrowers end up taking out multiple payday loans just to cover the fees and interest on their existing loans, leading to a dangerous cycle of indebtedness. The convenience of payday loans can come at a steep cost, and borrowers should explore all other options before deciding to take out a payday loan.

In summary, payday loans are a quick and easy way to access cash in an emergency, but they come with high costs and the potential for long-term financial hardship. Borrowers should carefully consider the terms of a payday loan and explore other alternatives before choosing this option.

What are personal loans?

Personal loans are a type of loan that is provided by a financial institution such as a bank, credit union, or online lender.

These loans are typically unsecured, which means they are not backed by collateral such as a car or house.

Borrowers can use personal loans for a variety of purposes, such as debt consolidation, home improvement, or unexpected expenses.

Personal loans are repaid over a fixed term, usually ranging from one to seven years, and the interest rates and fees vary depending on the borrower’s credit history and the lender’s policies.

How do personal loans work?

Personal loans are a type of loan that are borrowed from a bank, credit union, or online lender for personal use, such as home improvements, medical expenses, or large purchases. The borrower receives a lump sum of money upfront and agrees to pay back the amount borrowed, plus interest, over a set period of time. These loans are unsecured, meaning they are not backed by collateral, so the borrower’s creditworthiness is a major factor in the approval process.

When applying for a personal loan, the borrower will need to provide information about their income, employment, and existing debt obligations. Lenders will use this information to determine the borrower’s ability to repay the loan. If approved, the borrower will receive the funds in their bank account and can use them for any purpose they choose.

Personal loans typically have fixed interest rates, meaning the rate does not change over the life of the loan. The monthly payment is usually a fixed amount, making it easier for the borrower to budget and plan for repayment. Some lenders may also charge an origination fee, which is deducted from the loan amount before funds are disbursed.

As the borrower makes payments on the loan, the amount owed decreases, and the interest paid decreases over time. The loan is considered fully amortizing, meaning it will be paid off in full by the end of the repayment period, assuming all payments are made on time.

Key differences between payday loans and personal loans

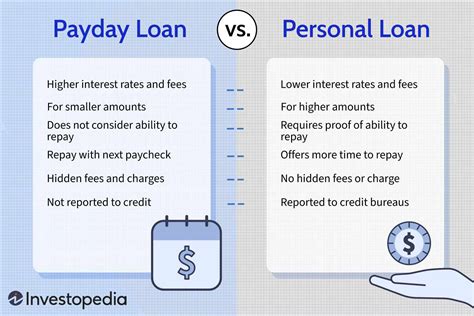

When it comes to borrowing money, there are different options available, including payday loans and personal loans. However, there are significant differences between these two types of loans in terms of amount borrowed, repayment period, interest rates, and fees.

Payday loans are typically small, short-term loans that are due on the borrower’s next payday. They are designed to provide quick cash to cover unexpected expenses or financial emergencies. In contrast, personal loans are usually larger amounts that are paid back over a longer period, often years, and can be used for a variety of purposes, such as debt consolidation, home improvement, or major purchases.

One key difference between payday loans and personal loans is the interest rates. Payday loans often come with extremely high interest rates, making them a costly form of borrowing. On the other hand, personal loans can have lower interest rates, especially for borrowers with good credit.

Another important difference is the fees associated with each type of loan. Payday loans often come with high fees and penalties for late payments, which can quickly add up and trap borrowers in a cycle of debt. Personal loans, on the other hand, may have origination fees, but are often more transparent and predictable in terms of overall costs.

Interest rates and fees comparison

Interest rates and fees are crucial factors to consider when comparing different loan options. Payday loans typically come with extremely high interest rates, often in the triple digits. This means that you could end up paying back significantly more than you borrowed. Additionally, payday loans often have fees and penalties for late payment, which can quickly escalate the cost of the loan.

On the other hand, personal loans generally offer lower interest rates compared to payday loans. The exact rate will vary depending on the lender and your credit score, but it’s typically much more favorable than what payday lenders offer. Personal loans may also have origination fees, but these are usually disclosed upfront and can be factored into the total cost of the loan.

When comparing the two options, it’s essential to consider the overall cost, including both the interest rate and any fees associated with the loan. While payday loans may seem more accessible, the high cost of borrowing makes them a less favorable option in the long run.

Ultimately, the choice between a payday loan and a personal loan comes down to the total amount you’ll pay back. Personal loans generally offer better terms and lower overall costs, making them a more attractive option for those in need of short-term financing.

Which loan option is better for you?

When it comes to choosing between payday loans and personal loans, it is important to consider the specific financial needs and circumstances. Payday loans are typically small, short-term loans that are intended to be repaid on the borrower’s next payday. On the other hand, personal loans are larger, long-term loans that are usually repaid over a period of months or years.

One key factor to consider when deciding which loan option is better for you is the amount of money you need to borrow. If you only need a small amount of cash to cover an unexpected expense, a payday loan might be a suitable option. However, if you need a larger sum of money for a major purchase or expense, a personal loan may be more appropriate.

Another factor to consider is the repayment terms and interest rates associated with each type of loan. Payday loans often come with high fees and interest rates, which can make them expensive to repay. Personal loans, on the other hand, may offer more favorable terms and lower interest rates, making them a more affordable option in the long run.

Ultimately, the best loan option for you will depend on your individual financial situation and needs. It is important to carefully consider the terms and conditions of each loan type and choose the option that aligns with your ability to repay and financial goals.

Frequently Asked Questions

What are payday loans?

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. They are designed to provide quick cash to individuals who may not have access to traditional forms of credit.

How do payday loans work?

To obtain a payday loan, a borrower typically writes a post-dated check for the amount they wish to borrow, plus a fee. The lender then gives the borrower the amount of the check minus the fee. On the due date, the borrower can redeem the check by paying the loan amount and the fee in cash, or allow the lender to deposit the check.

What are personal loans?

Personal loans are installment loans that are repaid over a period of time, usually with fixed monthly payments. They can be used for a variety of purposes, such as consolidating debt, making a large purchase, or funding a home improvement project.

How do personal loans work?

When a borrower applies for a personal loan, they receive a lump sum of money upfront and repay it over time with interest. The terms of the loan, including the interest rate, repayment schedule, and fees, are based on the borrower’s credit history and financial situation.

Key differences between payday loans and personal loans

The key differences between payday loans and personal loans include the repayment period, interest rates, and fees. Payday loans are typically due in full on the borrower’s next payday and come with high fees and interest rates. Personal loans, on the other hand, have longer repayment terms and lower interest rates.

Interest rates and fees comparison

Payday loans generally have higher interest rates and fees compared to personal loans. The annual percentage rate (APR) for payday loans can be as high as 400% or more, while personal loans may have APRs ranging from 6% to 36%, depending on the borrower’s creditworthiness.

Which loan option is better for you?

The best loan option for an individual depends on their financial situation and borrowing needs. Payday loans can provide quick access to cash, but they come with high costs and should only be used in emergencies. Personal loans offer lower interest rates and longer repayment terms, making them a more suitable option for larger expenses or debt consolidation.