Have you ever found yourself in a financial bind and considered taking out a payday loan? If so, you’re not alone. Payday loans can provide a quick solution to short-term financial needs, but it’s important to understand the ins and outs of these loans before diving in. One crucial aspect to consider is the interest rates that come with payday loans. In this blog post, we’ll take a closer look at the average interest rates on payday loans and what factors contribute to them. From understanding the basics of payday loans to exploring the impact of borrower credit scores and loan amounts on interest rates, we’ll cover it all. We’ll also discuss the role of state regulations and provide strategies for securing lower interest rates. So, buckle up and get ready to become an expert on payday loan interest rates!

Understanding Payday Loans

Payday loans are short-term, high-interest loans that are typically used by borrowers who need immediate access to funds. These loans are usually for small amounts, and are intended to be repaid on the borrower’s next payday. One of the main advantages of payday loans is the quick and easy access to cash, which can be especially useful in emergency situations. However, the high interest rates and fees associated with these loans can make them a costly option for borrowers.

When someone takes out a payday loan, they are typically required to provide proof of income and a post-dated check or authorization for electronic debit in the amount of the loan plus interest. The borrower then receives the loan amount, minus the lender’s fees and interest, and agrees to repay the loan on their next payday. If the borrower is unable to repay the loan in full, they may be allowed to roll the loan over into a new one, incurring additional fees and interest.

It’s important for borrowers to carefully consider the terms and costs associated with payday loans before taking one out. The high interest rates and fees can make it easy for borrowers to become trapped in a cycle of debt, where they have to take out new loans to pay off existing ones. While payday loans can provide short-term financial relief, they can also lead to long-term financial problems if not managed carefully.

Overall, it’s essential for borrowers to fully understand the terms of payday loans, including the interest rates and fees, in order to make informed decisions about their financial well-being.

Factors that Determine Interest Rates

When you apply for a loan, the interest rate you’re charged is one of the most important factors to consider. It determines how much you’ll have to pay back on top of the original loan amount. Several different factors go into determining the interest rate you’ll be offered, and it’s important to understand them before taking out a loan.

One of the biggest factors that determine interest rates is your credit score. Lenders use your credit score to assess the risk of lending to you. If you have a high credit score, meaning you have a history of paying your debts on time and in full, you’re likely to be offered a lower interest rate because you’re seen as a low risk borrower. On the other hand, if you have a low credit score, you may be offered a higher interest rate to offset the risk the lender is taking on.

Another important factor that determines interest rates is the loan term. Generally, shorter-term loans come with lower interest rates compared to longer-term loans. This is because lenders are taking on less risk with a shorter loan period, so they’re willing to offer a lower interest rate to attract borrowers.

Finally, the type of loan you’re applying for can also impact the interest rate you’re offered. For example, secured loans, which are backed by collateral, often come with lower interest rates compared to unsecured loans, which don’t require collateral. This is because the collateral provides the lender with security, reducing the risk for them.

The Impact of Borrower’s Credit Score

One of the major factors that determine the interest rates on a loan is the borrower’s credit score. A high credit score indicates to lenders that the borrower is financially responsible and is likely to repay the loan on time. As a result, borrowers with high credit scores are typically offered lower interest rates compared to those with lower credit scores.

On the other hand, borrowers with lower credit scores are considered to be higher risk by lenders, and are therefore charged higher interest rates to compensate for the increased risk of default. This means that individuals with lower credit scores may end up paying significantly more in interest over the life of the loan compared to those with higher credit scores.

It’s important for borrowers to understand the impact of their credit score on the interest rates they are offered, and to take steps to improve their credit score if necessary. This can include making timely payments on existing debts, reducing outstanding balances, and avoiding new credit inquiries.

Ultimately, maintaining a good credit score can result in significant savings on interest payments over time, making it an important factor to consider when applying for a loan.

How Loan Amount Affects Interest Rates

When it comes to taking out a loan, one of the key factors that can affect the interest rate you’re offered is the loan amount. Generally, the larger the loan amount, the lower the interest rate offered by the lender. This is because larger loan amounts typically involve less risk for the lender as they have the potential to earn a higher return on their investment. As a result, borrowers looking to take out larger loans can often secure more favorable interest rates.

On the other hand, smaller loan amounts often come with higher interest rates. This is because lenders may view smaller loans as riskier, as the potential returns for the lender may not be as substantial. As a result, borrowers looking to take out smaller loans may find themselves facing higher interest rates.

It’s important for borrowers to consider how the loan amount they are seeking can impact the interest rates they are offered. Understanding this relationship can help borrowers make informed decisions when it comes to borrowing money. Additionally, borrowers should shop around and compare interest rates from different lenders to ensure they are getting the best possible deal based on their desired loan amount.

Ultimately, the loan amount is a key factor that lenders consider when determining the interest rates they offer to borrowers. Borrowers should be aware of how the size of their loan can impact the interest rate they are offered, and take steps to secure the most favorable terms possible. By understanding this relationship and taking the time to explore their options, borrowers can work towards securing the best possible interest rates for their individual financial needs.

Comparing Interest Rates from Different Lenders

When you’re in the market for a loan, one of the most important factors to consider is the interest rate offered by different lenders. It’s crucial to compare rates from multiple sources to ensure you’re getting the best deal possible.

Interest rates can vary significantly between lenders, so taking the time to shop around and compare offers can save you a significant amount of money over the life of the loan.

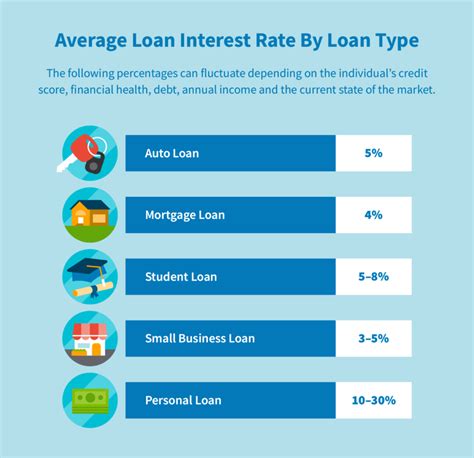

Whether you’re looking for a mortgage, personal loan, or auto loan, the interest rate you receive will have a direct impact on the total amount you’ll pay over the loan term. Even a slightly lower interest rate can result in significant savings, making it well worth the effort to compare rates from different lenders.

Factors such as your credit score, loan amount, and the type of loan you’re applying for will all play a role in the interest rate you’re offered. By obtaining quotes from several lenders, you can gain a better understanding of the range of rates available to you and make an informed decision.

The Role of State Regulations

When it comes to interest rates on loans, it’s not just the lender’s policies or the borrower’s credit score that come into play. In fact, state regulations also play a significant role in determining the interest rates that borrowers are subjected to. Each state has its own set of laws and regulations regarding lending practices, and this includes the maximum interest rates that lenders are allowed to charge. These regulations are put in place to protect consumers from predatory lending practices and to ensure that borrowers are not taken advantage of.

Some states have strict limits on interest rates, while others give lenders more freedom to set their own rates. For example, some states have usury laws that cap the maximum interest rate that can be charged on a loan, while others have no such restrictions. It’s important for borrowers to be aware of the regulations in their state, as this can have a significant impact on the overall cost of borrowing.

In addition to setting limits on interest rates, state regulations may also dictate other aspects of lending, such as fees and charges that can be imposed on borrowers. For example, some states have restrictions on the types of fees that lenders can charge, while others have no such limitations. This means that borrowers in different states may end up paying different amounts in fees, even if they are borrowing the same amount of money.

Overall, state regulations are a crucial factor in determining the cost of borrowing for consumers. Whether it’s setting limits on interest rates or regulating fees, these laws are designed to protect borrowers and ensure that they are not being taken advantage of by lenders. Borrowers should be aware of the regulations in their state and how they may impact their borrowing costs.

Strategies to Get Lower Interest Rates

When it comes to securing a loan, one of the most crucial factors to consider is the interest rate. A lower interest rate means less money paid over the life of the loan, which can result in significant savings for the borrower. Fortunately, there are several effective strategies that borrowers can implement to secure lower interest rates.

One of the most important strategies is to maintain a strong credit score. Lenders use credit scores to assess the risk associated with lending money to a borrower. Borrowers with higher credit scores are typically seen as less risky, and are therefore offered lower interest rates. By paying bills on time, keeping credit card balances low, and minimizing new credit inquiries, borrowers can improve their credit score and increase their chances of securing a lower interest rate.

Another effective strategy is to shop around and compare interest rates from different lenders. Each lender has its own criteria for assessing the risk of lending money, which can result in different interest rate offers. By obtaining quotes from multiple lenders, borrowers can identify the most competitive interest rates and potentially negotiate with lenders for even lower rates.

Borrowers can also consider making a larger down payment on the loan. By providing a larger down payment, borrowers are essentially reducing the amount of money they need to borrow. This can result in lower interest rates, as lenders may be more willing to offer favorable terms to borrowers who have invested a significant amount of their own money into the loan.

Frequently Asked Questions

What are payday loans?

Payday loans are short-term loans that typically have high interest rates and are meant to be paid back on the borrower’s next payday.

What factors determine the interest rates on payday loans?

The interest rates on payday loans are determined by factors such as the borrower’s credit score, the loan amount, and the state regulations.

How does the borrower’s credit score impact the interest rates on payday loans?

Borrowers with higher credit scores may receive lower interest rates on payday loans, while those with lower credit scores may be charged higher interest rates.

How does the loan amount affect the interest rates on payday loans?

Higher loan amounts may result in higher interest rates on payday loans, as lenders perceive greater risk with larger loan amounts.

How can borrowers compare interest rates from different lenders for payday loans?

Borrowers can compare interest rates from different lenders by obtaining quotes and terms from multiple sources and evaluating the total cost of the loan.

What role do state regulations play in determining interest rates on payday loans?

State regulations can affect the maximum interest rates and fees that lenders can charge for payday loans, which may impact the overall cost for borrowers.

What are some strategies to get lower interest rates on payday loans?

Borrowers can potentially get lower interest rates on payday loans by improving their credit score, exploring alternative loan options, and negotiating with lenders for better terms.