In today’s financial landscape, many individuals find themselves in need of quick and easy access to cash. Payday loans have become a popular option for those facing unexpected expenses or cash flow shortages. However, it’s important to understand the potential risks and rewards associated with these short-term, high-cost loans. In this blog post, we will explore the basics of payday loans, including how they work and who they are designed for. We will also discuss the potential risks involved in taking out a payday loan, as well as factors to consider before making the decision to borrow in this way. Additionally, we will look at the benefits and rewards of payday loans for those who use them responsibly, as well as how to avoid the pitfalls and manage debt. Lastly, we will discuss alternative options to payday loans and provide tips for responsible borrowing. Whether you’re considering a payday loan or simply want to learn more about this financial product, this post will provide valuable insights and information.

Understanding the basics of payday loans

Payday loans are short-term loans that are typically used to cover unexpected expenses or emergencies. These loans are usually small, ranging from $50 to $500, and are borrowed for a short period of time, usually until the borrower’s next payday. They are often sought after by individuals who are facing a cash crunch and need quick access to funds.

One of the key features of payday loans is the high interest rates and fees associated with them. Due to the short-term nature of these loans and the risk involved for the lenders, the interest rates can be significantly higher than traditional personal loans. It is important for borrowers to fully understand the terms and conditions, as well as the total cost of borrowing, before taking out a payday loan.

Additionally, payday loans are typically unsecured, meaning that they do not require any collateral. This makes them accessible to a wide range of borrowers, including those with poor credit history or no credit at all. However, this also means that the lender’s risk is higher, which is reflected in the high interest rates and fees.

Understanding the basics of payday loans is crucial for anyone considering this option. It is important to weigh the benefits and risks, and to explore alternative options before making a decision.

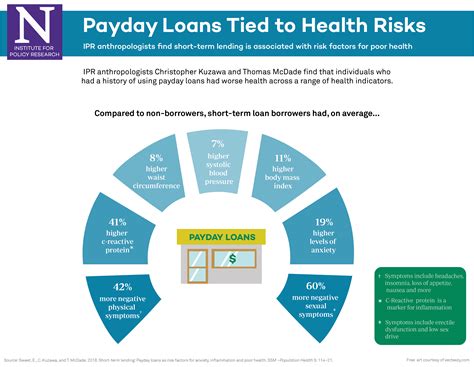

Assessing the potential risks involved

When considering the option of taking out a payday loan, it is essential to thoroughly examine the potential risks involved. These short-term, high-interest loans can provide immediate financial relief, but they also come with a number of drawbacks that must be carefully evaluated.

One significant risk to be aware of is the extremely high interest rates charged by payday lenders. Often reaching triple digits, these interest rates can quickly lead to a cycle of debt for borrowers who are unable to repay the loan in full on their next payday.

Another risk to consider is the possibility of falling into a cycle of dependence on payday loans. It can be tempting to repeatedly resort to these quick-fix loans as a solution to financial difficulties, but this can ultimately lead to long-term financial hardship.

Additionally, there is the risk of damaging one’s credit score if unable to repay the payday loan. Late payments and defaulting on these loans can have a negative impact on credit, making it more challenging to secure other forms of credit in the future.

Factors to consider before taking a payday loan

Before taking out a payday loan, it is important to carefully assess your financial situation. Consider whether you truly need the loan or if there are other options available to you. It’s crucial to evaluate the urgency of the financial need and whether the loan is the best course of action.

Another important factor to consider is the interest rates and fees associated with the loan. Payday loans often come with high interest rates and additional fees, so it’s important to understand the total cost of the loan and how it will impact your finances in the long run.

Additionally, borrowers should take into account their repayment ability before taking out a payday loan. It’s important to carefully consider whether you will have the means to repay the loan in full, including the interest and fees, by the due date. Failure to do so can result in additional financial hardship and potential debt.

Lastly, it’s essential to research and compare different lenders before deciding on a payday loan. Different lenders may offer varying terms and conditions, so it’s important to choose a reputable and trustworthy lender that offers fair and transparent terms.

Exploring the benefits and rewards of payday loans

Payday loans, often viewed with skepticism, can actually provide a variety of benefits and rewards to those in need of quick financial assistance. One of the main advantages of payday loans is the accessibility and ease of acquiring funds. Unlike traditional bank loans, payday loans typically have minimal eligibility requirements, making it easier for individuals with lower credit scores to obtain the money they need. This can be especially helpful in emergency situations where time is of the essence.

Additionally, payday loans offer convenience and flexibility, allowing borrowers to access funds quickly and without the hassle of lengthy application processes. This can be particularly beneficial for those facing unexpected expenses or financial emergencies. Moreover, payday loans can help individuals avoid late payment fees or overdraft charges, providing them with a financial safety net during times of need.

Furthermore, payday loans can also contribute to improving credit scores, as timely repayment of these short-term loans can demonstrate responsible financial behavior and potentially enhance one’s creditworthiness. This can be particularly advantageous for individuals looking to rebuild their credit history or establish a positive credit profile.

Overall, while payday loans are often criticized for their high interest rates and fees, it’s important to consider the potential benefits and rewards they can offer, especially for those in urgent need of financial assistance.

Avoiding the pitfalls and managing payday loan debt

Payday loans can be a quick fix for financial emergencies, but they also come with potential risks and pitfalls that need to be managed carefully. One of the most important aspects of responsibly using payday loans is avoiding the debt trap that can come with them. It’s essential to carefully consider your ability to repay the loan and to avoid borrowing more than you can afford to pay back. Managing payday loan debt requires a strategic approach and a clear understanding of the terms and conditions of the loan.

One key way to avoid the pitfalls of payday loan debt is to only borrow what you need and can comfortably repay. It’s important to resist the temptation to borrow more than you actually require. This can lead to a cycle of borrowing and repayment that becomes increasingly difficult to manage. By carefully assessing your financial needs and limitations, you can avoid falling into the trap of overwhelming payday loan debt.

Another important aspect of managing payday loan debt is planning for repayment. Before taking out a payday loan, it’s crucial to have a clear plan for repaying the borrowed amount. This may involve budgeting and prioritizing the repayment of the loan to ensure that it doesn’t become a long-term financial burden. By carefully managing your finances and staying organized, you can avoid the pitfalls of payday loan debt.

In addition to these strategies, it’s also important to be aware of alternative options to payday loans. In some cases, there may be alternative forms of financial assistance available that can help you avoid the potential risks and pitfalls of payday loan debt. Exploring these options and seeking financial guidance can be crucial in managing your financial situation and avoiding the negative impact of payday loan debt.

Alternative options to payday loans

When facing financial difficulties, many people turn to payday loans as a quick solution. However, these loans often come with high interest rates and fees, which can lead to a cycle of debt. That’s why it’s important to explore alternative options to payday loans.

One alternative option is to seek assistance from family and friends. While it may be difficult to ask for help, loved ones may be willing to provide a loan with more flexible terms, such as no interest or a longer repayment period. It’s important to communicate openly and honestly about the terms of the loan to avoid straining relationships.

Another alternative is to consider a personal loan from a bank or credit union. These institutions often offer lower interest rates and more manageable repayment plans. This option may require a good credit score, so it’s important to explore all eligibility requirements before applying.

Lastly, seeking financial assistance from nonprofit organizations and community resources can provide relief without the high cost of payday loans. These organizations may offer financial counseling, assistance with bill payments, and access to low-interest loans for those in need.

Tips for responsible payday loan borrowing

When considering taking out a payday loan, it’s important to approach the process with caution and responsibility. It can be tempting to borrow more than you can afford when faced with a financial emergency, but it’s crucial to assess your financial situation and borrow only what you need.

One tip for responsible borrowing is to carefully review the terms and conditions of the loan before signing any agreement. Make sure you fully understand the interest rates, repayment terms, and any additional fees that may be associated with the loan.

Another important tip is to create a realistic repayment plan before taking out the loan. Calculate how much you can afford to repay each month without putting yourself in a difficult financial situation. It’s crucial to prioritize paying off the payday loan to avoid falling into a cycle of debt.

Lastly, it’s important to explore alternative options before turning to a payday loan. Consider reaching out to family or friends for financial assistance, seek out community resources, or explore other loan options with lower interest rates and more flexible repayment terms.

Frequently Asked Questions

What are payday loans and how do they work?

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. To obtain a payday loan, a borrower writes a postdated check for the amount of the loan plus fees, or gives the lender authorization to electronically debit the funds from their bank account.

What are the potential risks of using payday loans?

The potential risks of using payday loans include high interest rates, fees, and the risk of getting trapped in a cycle of debt if the loan is not repaid on time.

What factors should be considered before taking a payday loan?

Before taking a payday loan, borrowers should consider their ability to repay the loan, the total cost of borrowing, and alternative options available to them.

What are the benefits and rewards of using payday loans?

The benefits and rewards of using payday loans include quick access to funds, no credit check requirement, and potential for approval even with a poor credit history.

How can borrowers avoid the pitfalls of payday loans and manage payday loan debt?

Borrowers can avoid the pitfalls of payday loans by only borrowing what they can afford to repay, understanding the terms and conditions of the loan, and seeking financial counseling if they find themselves in debt.

What are some alternative options to payday loans?

Alternative options to payday loans include borrowing from family or friends, seeking an advance from an employer, or exploring other types of consumer loans such as installment loans or lines of credit.

What are some tips for responsible payday loan borrowing?

Some tips for responsible payday loan borrowing include only borrowing what is absolutely necessary, budgeting for the repayment, and comparing offers from multiple lenders to find the best terms.